If you’re forced at the end of the year to sort through all your receipts and put them in order, it’s time to switch to a new system.

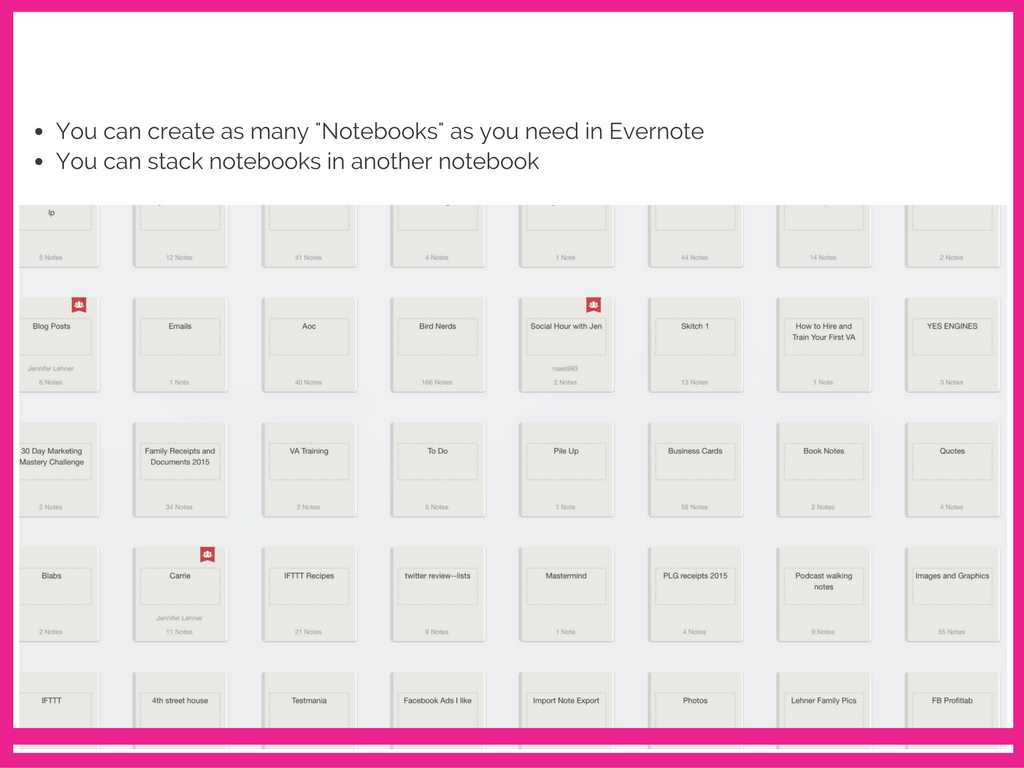

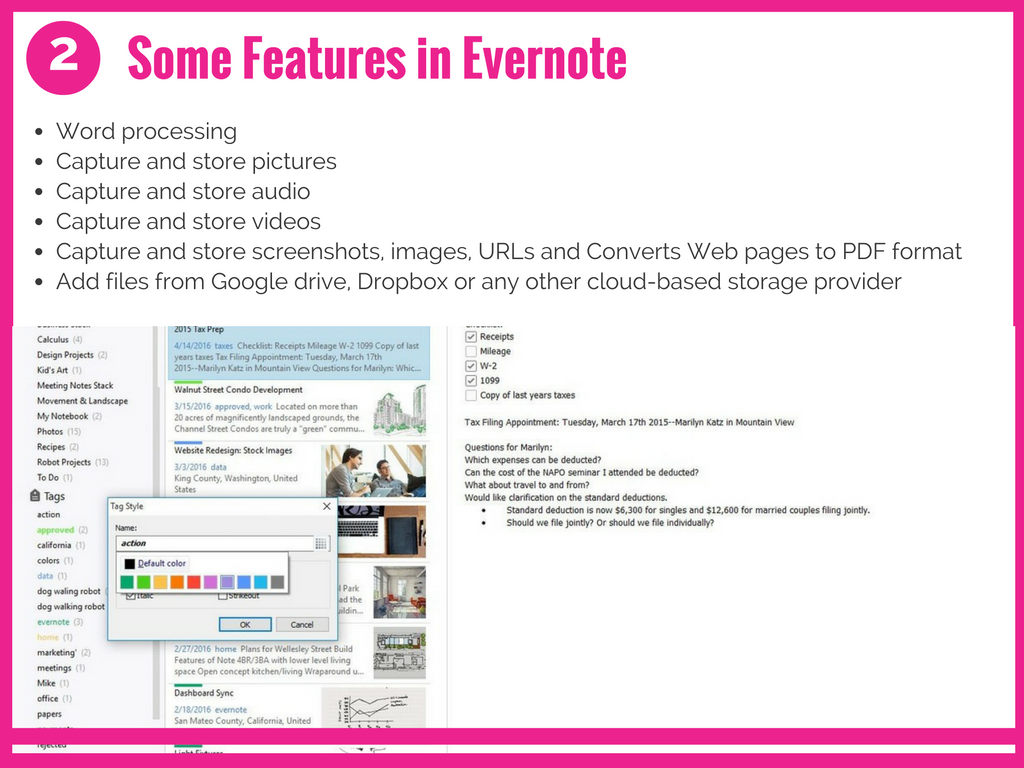

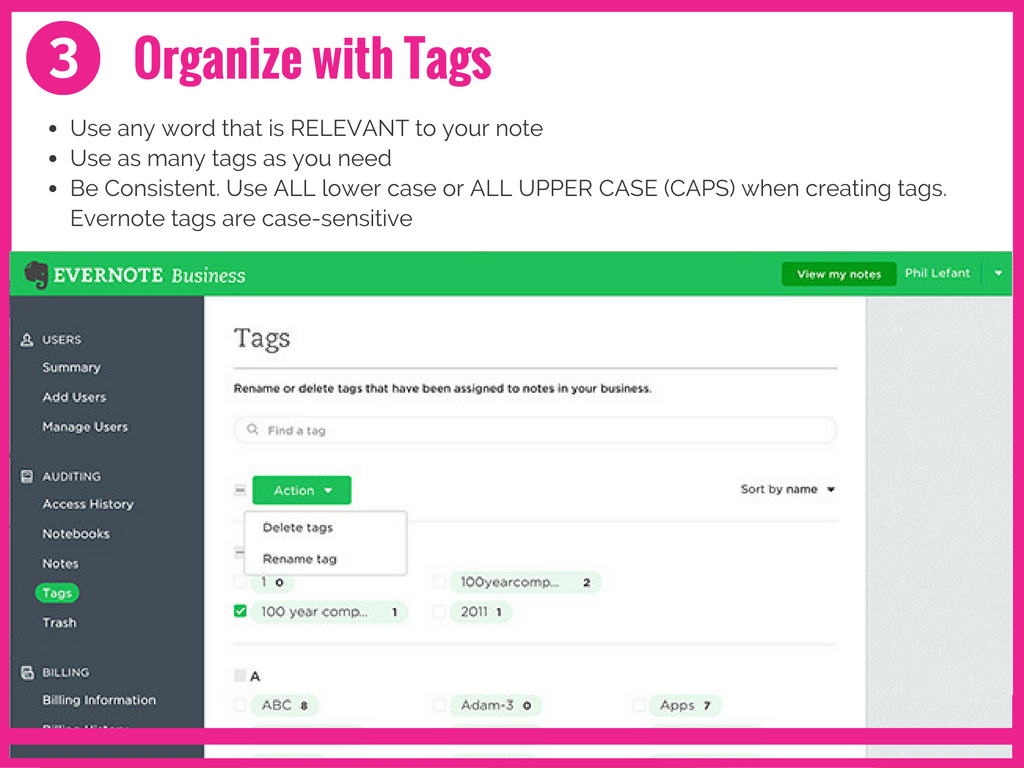

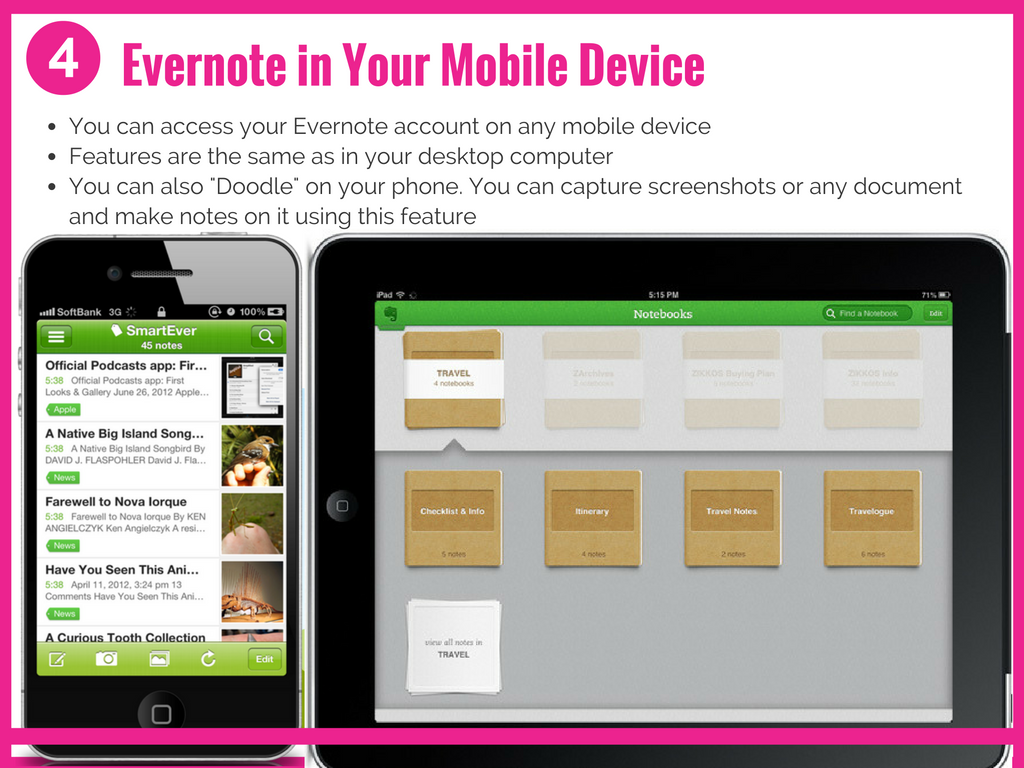

Going paperless cuts down on clutter and helps make sure nothing slips through the cracks. Apps like Expensify allow you to photograph and categorize your receipts, then upload them to the cloud—where they’ll be organized by type, and protected from hazards like sudden gusts of wind. Or you can just use Evernote, which is one of my favorite apps of all time.

3. Set aside money for taxes

When you’re self-employed, it’s up to you to figure out how much you owe in taxes, and pay it to the IRS.

That may sound like a big responsibility. But don’t worry: A few shortcuts can help.

This is the part where I have to tell you about Profit First, which is actually a book by Mike Michalowicz. His system has completely changed my business, for the better.

Finances really aren’t my strong suit, but I’m a systems girl. And his system is very straight-forward, even for the most financially illiterate (like me!). In short, you routinely move money each quarter into separate bank accounts...most importantly, taxes/profits/and operating expenses. Kind of how your grandmother or great grandmother used to take the paycheck and put the mortgage in one envelope, money for groceries in another, utilities in another, and so on. What was left over was left over. In the Profit First system, this guarantees that you actually see a profit because you are moving it to your profit account. He also spells out how to figure out what percentage of what goes where.

But generally speaking, if you aren’t using the Profit First System, you want to follow the 30 % rule. You want to be prepared to pay about 30% of your gross income to the IRS as taxes. If you’re going back retroactively to put together money for tax payments, get together 30% of your income for the year. (This is when it’s handy to have year-end financial statements—so you can easily see how much you earned for the year.)

Next year, save yourself the hassle of sorting out taxes retroactively: Set them aside as you earn.

Set aside taxes well in advance

There are three methods for setting aside taxes as you earn income: Per-payment, monthly, and yearly.

Per-payment works well if you invoice clients. Every time a client pays you, take 30% and set it aside for taxes.

Monthly is best if your business goes through a lot of transactions every month—for instance, if you run a bustling ecommerce business. In that case, each month, set aside 30% of your gross income.

The yearly approach only makes sense if your business is small, you earn income infrequently, and you don’t need to make estimated quarterly payments. If your business is still in its side hustle phase, it may be okay to go back and set aside cash at the end of the year. Still, there’s no reason you can’t start using the monthly or per-payment method now—it’ll establish good habits for later on, when your business grows and your income is higher.

Create a separate account

Dipping into your tax savings is a major no-no. You don’t want to come up short at the end of the year, unable to pay your taxes. The best way to keep your tax withholdings separate from the rest of your income is to create a separate savings account. That way, you’ll know exactly how much you have—and you’ll be less tempted to spend it.

4. Get up to date on tax reforms

*Yawn*...fight the urge to nod off. “Tax reforms” may not be the most thrilling pair of words in the English language, but they’re important.

That’s because, every year, the IRS makes changes to tax laws. That could mean you’re no longer eligible for certain tax deductions, or the deadlines for filing certain forms have changed.

For instance: The most recent major change to taxes was the Tax Cuts and Jobs Act, in 2018. It set a new tax rate for C corporations—so if your business was incorporated, you’d end up owing less than you may have planned. It introduced a new deduction for so-called “pass through entities”—so if you ran a sole proprietorship or single-member LLC, you had a new way to write off expenses. And it made changes to which deductions businesses could claim across the board.

These changes are important to stay on top of. Every year, the IRS puts out Publication 5318. It tells businesses what kinds of changes to tax law they can expect in the coming year. Make sure you read it when it’s published.

You may want to hire a CPA to file your taxes. It’s their job to stay on top of the latest changes in tax law, and make sure you’re in compliance.

I’ve been using the same local firm for years and have developed a relationship with them so I’m sticking with them. But Bench just added tax/accounting services, too. Your bookkeepers will work one-on-one with tax professionals to get your taxes filed and 100% compliant with the current year’s tax laws.

So you don’t need to bring your books to a CPA, and explain how your business works. Since your Bench team produces all your financial statements throughout the year, and has hands-on knowledge about your expenses, they can work with professional tax filers to make sure your return is prepared accurately, and taking advantage of write-offs.

Ooh lah lah. Sexy, right?

5. Get the new year off to a great start

This New Year’s Eve, make a resolution to run your business more smoothly and effectively than you did the year before. Here are a few simple steps you can take to make it happen:

Do an internal audit.

Don’t let the word “audit” scare you. An internal audit looks at your accounting processes and operations, and makes sure that everything is running as efficiently and cost-effectively as possible.

Taking time to review your standard practices—how and when you record transactions on the books, how you store your business records, your invoicing cycle—can highlight ways to improve. That could mean entering sales on the books nightly, instead of weekly. Or, it could mean putting a whole new accounting system in place. Either way, your business will benefit.

2. Prepare financial reports

If you haven’t been disciplined about preparing financial reports, now is the time to start. Make sure that, by the end of January, you’ve got an income statement, cash flow statement, and balance sheet for the month. Then rinse and repeat: Your aim is to have accurate, up to date financial reports for every month of the year.

These taxes won’t only make it easier to file your taxes at the end of the year. You’ll have all the information you need to make informed business plans—like deciding how to reinvest income, or where to reduce expenses. That could mean more profit for your business in the long run.

3. Put together a financial forecast

When you create a financial forecast, you look at how your business has performed in the past, then project that performance into the future. It helps you prepare for events to come, and see where your business will end up depending on which business moves you make.

Once you’ve created a financial forecast, you can refer to it throughout the year to help you make business decisions. For instance, a forecast can help you identify your busy and slow seasons, and how investments in your business will pay off. That could affect everything from your operating hours during certain times of the year, to whether you take out a loan to expand your business.

This guide to financial forecasting is straightforward, and includes examples you can use to create your own forecasts.

By taking five straightforward steps at the end of the year, you can make sure next year goes smoothly.

You definitely want to wrap up the previous year’s accounting neatly, and make sure everything adds up and makes sense. Then you’re ready to file your taxes, or have somebody, or a service like Bench, do it for you. I’m a huge fan of outsourcing, and creating systems in our businesses, (which is why I created Front Row CEO (launching in January).) Financial stuff doesn’t interest me, it gives me a headache, and it’s definitely one of those things I’d rather hand over to an expert.

Did I miss any year-end tasks? Let me know in the comments below.

*Some of the links in this article are affiliate links. That means that I get some sort of small reward for you sharing with you if you end up purchasing. I only recommend products and services that I personally use and love.