What is a virtual assistant?

A virtual assistant is a human being (I’m not referring to Siri, or Alexa, or an operating system akin to what you may have seen in the movie, “Her”). This is a person who works remotely in your business. They could be on another floor in your business, or on the other side of the world.

When I talk about virtual assistants, I’m referring to a generalist. This person will likely have expertise in one particular area, but their role in your business will be broad. When looking for a specialist assistant, I think more of “project manager”.

“Am I ready for a VA?”

More often than not, I am inclined to say “yes you are”.

How can that be? How can I be so sure that you are ready when I don’t know you or your business?

Because, when set up correctly, two heads are better than one. It’s that simple.

I don’t need to know your revenue in your business, because you can start with a virtual assistant, part time, for about $100 a week. (If you cannot spare $100 a week in your business, I would argue that you don’t have a business, you have a hobby.)

I don’t need to know what industry you are in, because whether you are B2B, B2C, brick and mortar, or a professor at an ivy league school, a virtual assistant is going to help you get where you need to go, FASTER.

But there are certain things to consider before you take the plunge:

The first and most important question to ask yourself is, “Am I ready to let go of some things?”.

I have a friend who runs an online business who told me that she left her corporate job because she was sick of managing people. She loves being alone in her business. She loves the feeling of freedom that comes with that. She knows her business would grow faster and that she would be more profitable if she hired someone, but to her, it’s not worth it. She’s happy with the slow but steady growth of her business. So obviously, it would not be a good idea for her to hire a VA.

You need to make sure that you WANT the help. That you WANT to share the highs and lows and twists and turns with someone else.

It may be that you’ve hired someone before, but it was more trouble than it was worth. Either they didn’t perform as well as you had hoped, or you spent so much time trying to keep them busy, you didn’t get anything done! You fell into the “might-as-well-do-it-myself” trap. And this is very common.

The good news is, once you make up your mind that you want to hire a VA, the pre-work you need to do ahead of time to set yourself up for success is not as overwhelming as you imagine.

You don’t have to have perfectly organized Drop Boxes, meticulous spreadsheets, a content calendar, or a color-coded Trello board.

But you do need to take these next steps:

1. Define : What is it you need help with most immediately? Social media posting? Email management? Research? If you don’t know what you need help with, you won’t be able to set success metrics for your new VA. Everyone needs to know what success looks like.

Completing the following sentence will help you to hone in on exactly your expectations are:

I need help with _________(social media management)_________ so that I can___________ (increase new leads by 20% each month)________.

Now that you know why you need a VA and what you want him/her to help you with, it’s helpful to put in place a few systems or processes so that once you hire your VA, they can work without you, or with minimal oversight. The more you can remove yourself from the process, the better.

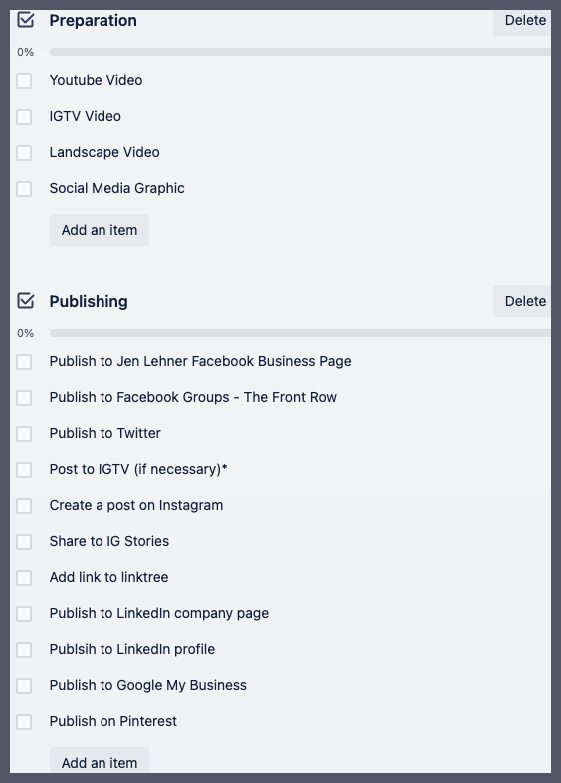

Here’s an example of a simple social media management process.